SSD shipments outpaced HDDs by 3:2 last quarter, but hard disks still lead the storage race

In brief: We've come a long way since solid-land drives were the expensive alternative to traditional HDDs, making upwardly only a pocket-size office of the market place. Falling prices and increasing capacities have seen their popularity ascent in contempo times, to the point that in Q1 2022, SSD shipments outpaced their hard disk drive counterparts by iii:2, while in 2022, SSDs saw 28% more unit of measurement sales than HDDs.

According to a Trendfocus report (via Tom's Hardware), three hard drive makers shipped as many as 64.17 one thousand thousand HDDs in Q1 2022, while fewer than a dozen SSD suppliers shipped 99.438 million SSDs during the same period.

We all know the typical speed and concrete size advantages that come with SSDs, so the figures aren't too surprising; a recent IDC report revealed that nearly 60% of new PCs shipped in Q1 used SSDs.

The trend of SSDs outselling HDDs isn't new. A jump in fourth-quarter sales last year helped SSDs push past 333 million units for the entirety of 2022, moving ahead of the 260 one thousand thousand HDD units sold.

One surface area where HDDs accept an advantage, of course, is their superior $/gigabyte ratio, which makes them ideal for enterprise solutions. And while datacenters do still use SSDs for caching, it ways the total exabytes (EBs) shipments for HDDs in the outset quarter far exceeded that of SSDs: 288.28 EBs vs. 66 EBs.

Solid-country drives are bringing in more money, too. Analyst firms had the SSD market valued at $34.86 billion in 2022, while HDDs lagged behind with $22.6 billion.

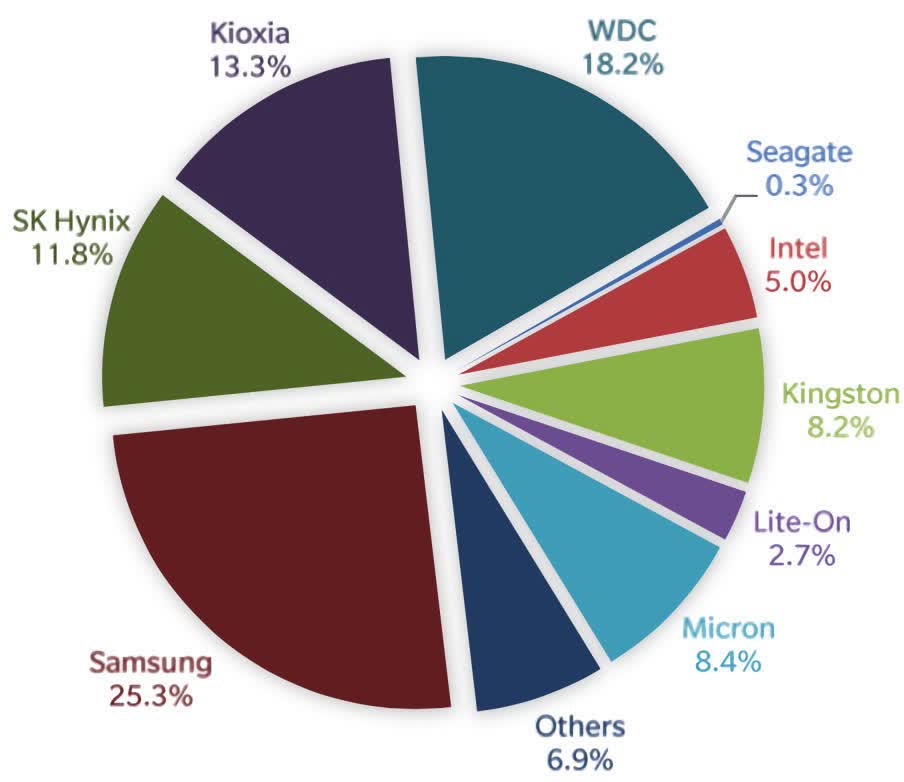

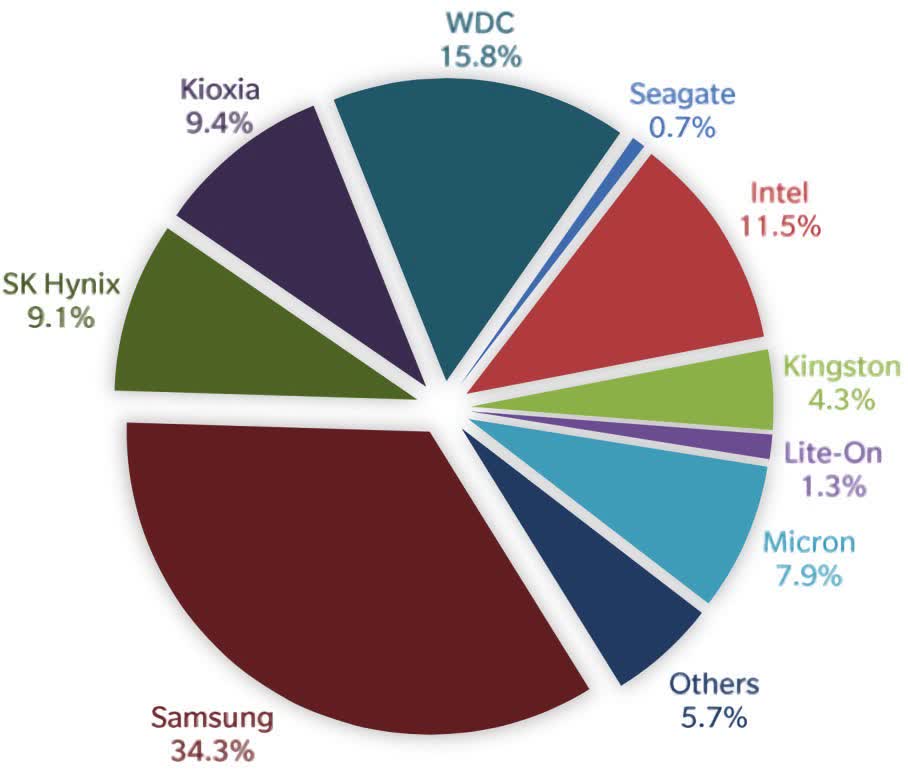

As with and so many tech products, Samsung, the top supplier of NAND flash retention, is the manufacture leader when it comes to SSDs, boasting the largest market share for units shipped (25.3%) and exabytes (34.3%). Information technology's followed past Western Digital (18.2% units and 15.8% EBs) and then Koxia—formerly Toshiba Memory (13.iii% units and ix.iv% EBs).

SSDs, and the storage market in general, is facing a tough time right now—despite the positive report. The shortage of SSD controllers is expected to affect sales, while the introduction of cryptocurrency Chia, which can ruin a 512GB SSD in 40 days, is starting to impact drive supply and prices in some areas.

Source: https://www.techspot.com/news/89788-ssd-shipments-outpaced-hdds-32-q1-but-hard.html

Posted by: garrisonvaccom.blogspot.com

0 Response to "SSD shipments outpaced HDDs by 3:2 last quarter, but hard disks still lead the storage race"

Post a Comment